In this week’s recap: stocks rally, China schedules tariff cuts, January hiring tops expectations, and a key gauge of manufacturing activity improves.

Weekly Market Commentary |Presented by Sterling Wealth Advisors |February 10, 2020

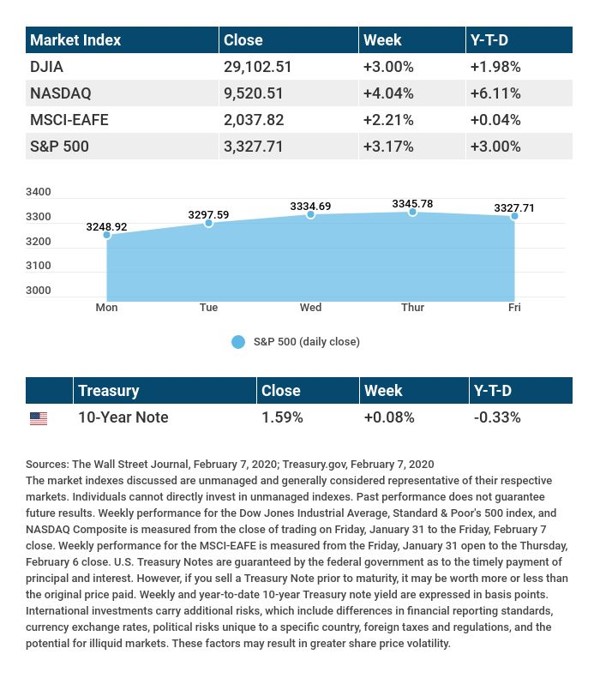

Stocks advanced four days out of five during the past market week, erasing the losses of the week before.

The Nasdaq Composite surged 4.04%, the S&P 500 3.17%, and the Dow Jones Industrial Average 3.00%. Foreign stocks also rallied: the MSCI EAFE index added 2.21%.1,2

China Plans to Halve Some Tariffs

Thursday, investors woke up to the news that China would be lowering import taxes on about $75 billion of U.S. products. Later this week, a set of 10% tariffs is slated to drop to 5%, and a group of 5% tariffs is scheduled to fall to 2.5%.

This reduction is part of the phase-one trade deal that China agreed to last month, a pact which may be a step toward a trade truce with the U.S.3

January’s Net Job Gain: 225,000

The Department of Labor’s latest employment report exceeded expectations. Economists surveyed by Bloomberg projected 165,000 net new hires last month. The main jobless rate ticked north to 3.6%; the U-6 rate including the underemployed rose 0.2% to 6.9%.

This upside surprise points to ongoing strength in the economy. Stocks declined Friday after the report’s release, however, as traders viewing the data saw less reason for a Federal Reserve rate cut in the near future.4

A Manufacturing Positive

The U.S. factory sector grew last month, for the first time since July. The Institute for Supply Management’s purchasing managers index for the manufacturing sector, which traders view as a fundamental economic indicator, came in at 50.9 in January; any reading above 50 indicates sector expansion.5

WHAT’S AHEAD

Investors should note that U.S. stock and bond markets will be closed on Monday, February 17 for Presidents Day.

TIP OF THE WEEK

By continuously reviewing your business budget, you can pinpoint how well your company is following its financial objectives throughout the year.

Tuesday: Federal Reserve chairman Jerome Powell begins two days of testimony in Congress on U.S. monetary policy.

Thursday: The federal government’s January Consumer Price Index, measuring monthly and yearly inflation.

Friday: January retail sales data from the Census Bureau, and the University of Michigan’s preliminary February consumer sentiment index, an evaluation of consumer confidence levels.

Source: MarketWatch, February 7, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Allergan (AGN), RingCentral (RNG)

Tuesday: Exelon (EXC), Hilton Worldwide Holdings (HLT)

Wednesday: CME Group (CME), Cisco (CSCO), CVS Health (CVS), Shopify (SHOP)

Thursday: Alibaba (BABA), Nvidia (NVDA), PepsiCo (PEP)

Friday: AstraZeneca (ABBV), Enbridge (ENB)

Source: Zacks.com, February 7, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“We always admire the other person more after we’ve tried to do his job.”

WILLIAM FEATHER

THE WEEKLY RIDDLE

You can rest on my pad without touching the keys. I will sing all month long as long as you pay your fees. What am I?

LAST WEEK’S RIDDLE: There is a word for a place in Europe, a place where many travelers like to go. But, if you take the first letter of this word and put it at the end of the other four letters in the word, you have something no one likes. What is this word?

ANSWER: Spain (Pains).

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Wealth Advisors and Cambridge are not affiliated.

To learn more about Sterling Wealth Advisors, visit us on the web at www.sterlingwealthadvisorstx.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1 – wsj.com/market-data [2/7/20]

2 – quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [2/7/20]

3 – cnn.com/2020/02/06/economy/china-tariffs-coronavirus/index.html [2/6/20]

4 – tinyurl.com/utpxrzd [2/7/20]

5 – ycharts.com/indicators/us_pmi [2/6/20]

CHART CITATIONS:

wsj.com/market-data [2/7/20]

quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [2/7/20]

quotes.wsj.com/index/SPX/historical-prices [2/7/20]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [2/7/20]