In this week’s recap: stock indexes rise, Jerome Powell reports on monetary policy to Congress, inflation hits a 15-month peak, and new data on retail sales and consumer sentiment appears.

Weekly Market Commentary |Presented by Sterling Wealth Advisors |February 17, 2020

Daily headlines about the coronavirus had little impact on stock market averages last week. Earnings and mergers had more influence.

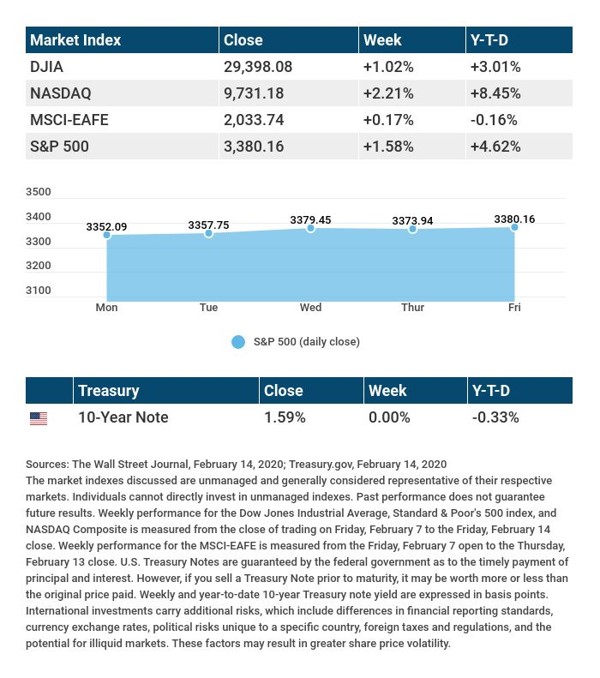

All three Wall Street benchmarks improved. The Nasdaq Composite rose 2.21%, outpacing the S&P 500, up 1.58%, and the Dow Jones Industrial Average, up 1.02%. The MSCI EAFE index, which tracks developed overseas equity markets, added 0.17%.1,2

Jerome Powell Testifies on Capitol Hill

Commenting that the economy is in a “very good place,” Federal Reserve Chairman Jerome Powell told congressional legislators that he did not currently see a significant recession risk.

“There’s nothing about this expansion that is unstable or unsustainable,” Powell remarked during his semi-annual report to the House Financial Services Committee. He did reiterate that the central bank was “carefully” watching the coronavirus outbreak, and that it could “very likely” have residual economic impact on the U.S.3

Yearly Inflation Reaches 2.5%

Consumer prices have not advanced to this degree since the 12-month period ending in October 2018. Underneath this January headline inflation number, core inflation (minus food and energy prices, which are often volatile) was up 2.3% year-over-year.

These numbers are from the Consumer Price Index, maintained by the Bureau of Labor Statistics. The Federal Reserve monitors inflation using its core personal consumption expenditures (PCE) index, which remains below the central bank’s 2% yearly inflation target.4

Gains in Retail Sales, Sentiment

The Census Bureau said retail sales were up 0.3% in the first month of the year, matching the consensus forecast of analysts polled by MarketWatch. Additionally, the University of Michigan’s preliminary February consumer sentiment index monitoring consumer confidence factors went back above 100 last week (100.9).5

Final Thought

The S&P 500 has risen more than 1% since the coronavirus surfaced. During the SARS epidemic of 2003, the MERS outbreak of 2013, and the 2015-16 Zika virus breakout, the index declined.6

TIP OF THE WEEK

If you have accumulated multiple retirement plan accounts over the years, you may want to consider consolidating some of those balances into one account, as a move to simplify your retirement savings effort.

Tuesday: Medtronic (MDT), Walmart (WMT)

Wednesday: Analog Devices (ADI), NetEase (NTES)

Thursday: Dominos (DPZ), Hormel Foods (HRL), Southern (SO)

Friday: Deere & Co. (DE), Royal Bank of Canada (RY)

Source: Zacks.com, February 14, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Sooner or later we all quote our mothers.”

Bern Williams

THE WEEKLY RIDDLE

Four women sit down to play, playing after the end of the day, playing for cash, not for fun, a separate score for everyone. Not one lost, and all gained. Now that you’ve heard this, can you explain … what they did, and why it happened this way?

LAST WEEK’S RIDDLE: You can rest on my pad without touching the keys. I will sing all month long as long as you pay your fees. What am I?

ANSWER: A smartphone.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Wealth Advisors and Cambridge are not affiliated.

To learn more about Sterling Wealth Advisors, visit us on the web at www.sterlingwealthadvisorstx.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1 – wsj.com/market-data [2/14/20]

2 – quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [2/14/20]

3 – tinyurl.com/tu8tre5 [2/11/20]

4 – cnbc.com/2020/02/13/us-consumer-price-index-rose-0point1percent-in-january-vs-0point2percent-expected.html [2/13/20]

5 – marketwatch.com/tools/calendars/economic [2/14/20]

6 – cnbc.com/2020/02/13/us-futures-point-to-lower-open-on-wall-street.html [2/13/20]

CHART CITATIONS:

wsj.com/market-data [2/14/20]

quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [2/14/20]

quotes.wsj.com/index/SPX/historical-prices [2/14/20]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [2/14/20]