In this week’s recap: increase in COVID-19 cases, matched with downbeat Federal Reserve forecast, weighed on markets.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |June 15, 2020

Investor sentiment turned negative last week, amid an increasing number of COVID-19 cases in states where re-opening has been underway as well as a subdued economic forecast from the Federal Reserve.

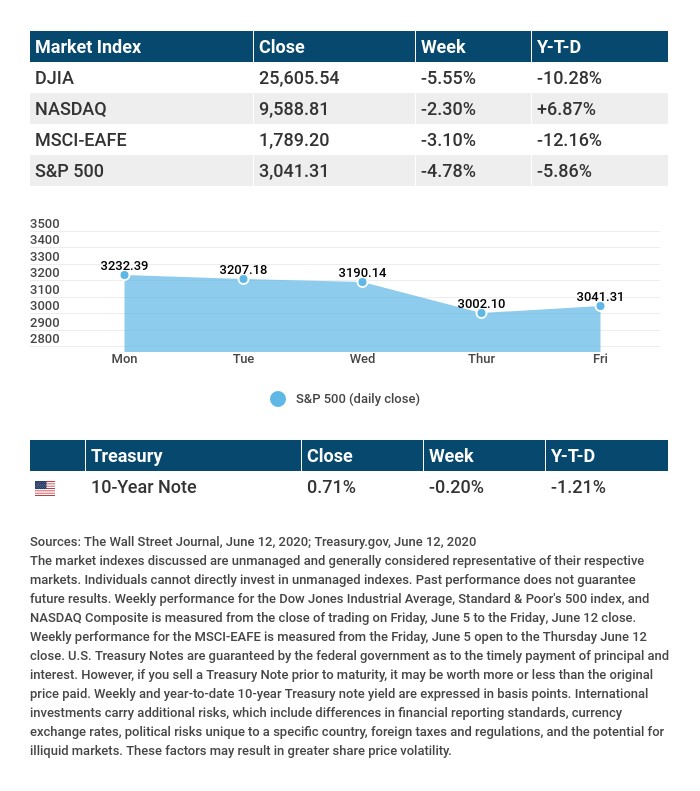

The Dow Jones Industrial Average dropped 5.55%, while the Standard & Poor’s 500 lost 4.78%. The Nasdaq Composite Index slipped 2.30% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, fell 3.10%.1,2,3

Reality Bites

The optimism that drove stock prices higher these past several weeks slipped away on reports of a jump in COVID-19 cases, which sparked worries of a second wave slowing the economic recovery. A sober forecast for the economy by the Federal Reserve further dampened investor sentiment.

The week started upbeat with “re-opening” stocks, e.g., financials, transportation, retailers, travel and leisure, and industrials, leading the way higher. But the momentum was soon lost as stocks turned mixed on Tuesday and Wednesday and then moved decidedly downward, with the S&P 500 losing 5.9% on Thursday.4

Amid a volatile week, big technology companies resumed their market leadership, with the NASDAQ Composite closing above 10,000 for the first time. Stocks pared their losses on Friday, but it wasn’t enough.5

Fed Forecasts Economic Growth and Interest Rates

On Wednesday, the Federal Reserve said that it would keep the federal funds rate near zero and maintain its monthly purchases of Treasury bonds and mortgage-backed securities.

The Fed also issued its forecasts for 2020-2022, indicating that it saw its benchmark federal funds rate remaining at zero, with inflation at 0.8% for 2020, increasing to 1.6% in 2021, then to 1.7% in 2022. Fed officials also expect the economy to shrink by 6.5% this year, with Gross Domestic Product growing 5% and 3.5% in 2021 and 2022, respectively. Their forecast for unemployment predicts a steady decline over the next 2½ years, from 9.3% by the end of 2020 to 5.5% in 2022.6

TIP OF THE WEEK

If you’re trying to save money or track your spending, consider using cash. Cash is real. You can see it, and you know when you’re out of it. Money becomes more abstract when you use a credit or debit card, leaving you more open to financial choices that you may later regret.

Tuesday: Retail Sales. Industrial Production.

Wednesday: Housing Starts.

Thursday: Jobless Claims. Index of Leading Economic Indicators.

Source: Econoday, June 12, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Oracle (ORCL), Lennar (LEN).

Thursday: Kroger (KR).

Source: Zacks, June 12, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Character is much easier kept than recovered.”

THOMAS PAINE

THE WEEKLY RIDDLE

The names of two U.S. state capital cities rhyme, but they share no vowels. Can you name the two cities?

LAST WEEK’S RIDDLE: What is the timepiece with the most moving parts? (It’s been around for centuries.)

ANSWER: The hourglass.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1 – The Wall Street Journal, June 12, 2020

2 – The Wall Street Journal, June 12, 2020

3 – The Wall Street Journal, June 12, 2020

4 – The Wall Street Journal, June 11, 2020

5 – CNBC, June 12, 2020

6 – CNBC, June 10, 2020

CHART CITATIONS:

The Wall Street Journal, June 12, 2020

The Wall Street Journal, June 12, 2020

Treasury.gov, June 12, 2020