In this week’s recap: stocks gain after volatile week, despite COVID-19 acceleration.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |July 13, 2020

Stock prices notched solid gains last week, looking past an increase in COVID-19 cases and any potential economic concerns raised by the trend.

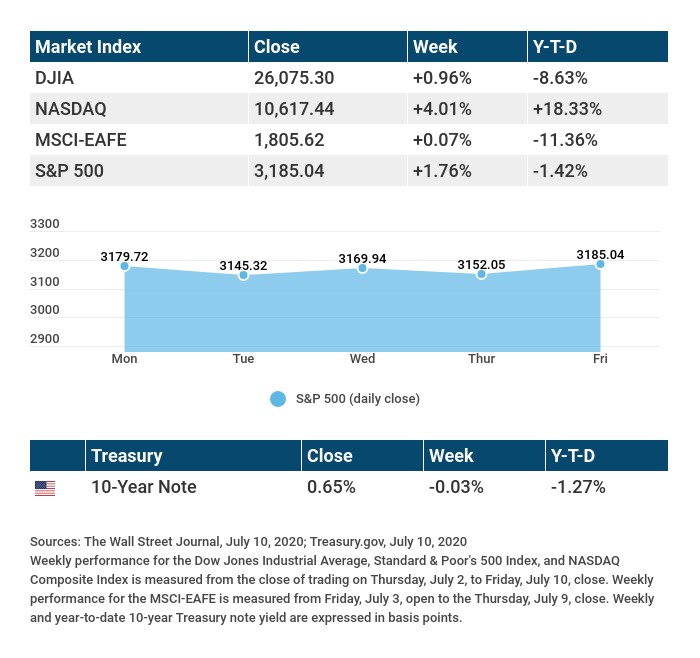

The Dow Jones Industrial Average increased by 0.96%, while the Standard & Poor’s 500 climbed 1.76%. The Nasdaq Composite Index bounded 4.01% higher for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, gained just 0.07%.1,2,3

Virus Concerns

Stocks experienced a volatile week as investors negotiated the crosswinds of encouraging overseas economic data with an accelerating number of COVID-19 cases in several states. Ongoing support of the financial markets by the Federal Reserve appeared to offset any concerns about an economic rebound.

The big technology companies continued to shine, leading the Nasdaq Composite to multiple new record highs. News of positive trial results for a potential COVID-19 treatment boosted stocks on the final trading day, closing the week on an encouraging note.

On the Record

Regional Federal Reserve presidents had several speaking engagements last week, and the message was a consistent one: expect the economic recovery to remain bumpy.

Cleveland Fed President Loretta Mester said that the economy in her region is slowing due to rising COVID-19 cases. She linked gains in combating the virus with further economic progress. She also echoed earlier comments by Fed Chairman Powell that more fiscal support is necessary.4

Meanwhile, San Francisco Fed President Mary Daly observed that it was unlikely many companies would be rehiring all their employees. Thomas Barkin, president of Richmond Federal Reserve, reiterated the challenges of a labor recovery, but also spoke of the strain on local and state governments.5,6

TIP OF THE WEEK

Ramp up your college savings with rewards programs. There are credit cards and online shopping programs that can allow you to direct a steady stream of rebates toward your education fund.

Tuesday: Consumer Price Index (CPI).

Thursday: Jobless Claims. Retail Sales.

Friday: Housing Starts.

Source: Econoday, July 10, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: PepsiCo, Inc. (PEP).

Tuesday: JPMorgan Chase & Co. (JPM), Citigroup (C), Wells Fargo (WFC).

Wednesday: International Business Machines (IBM), Goldman Sachs (GS), eBay, Inc. (EBAY).

Thursday: Microsoft (MSFT), Netflix (NFLX), Bank of America (BAC), Johnson & Johnson (JNJ), UnitedHealth Group (UNH), Abbott Laboratories (ABT), Morgan Stanley (MS), Honeywell International (HON).

Friday: Blackrock, Inc. (BLK).

Source: Zacks, July 10, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“The longer I live, the more I realize the impact of attitude on life.”

MARK TWAIN

THE WEEKLY RIDDLE

A parking lot has 1,000 parking spaces, 40% of them for compact cars. There are 200 compact cars and some standard-size cars in the lot, which is 75% full. How many standard-size cars are in the lot?

LAST WEEK’S RIDDLE: To date, only one bachelor has served as President of the United States. Can you name him?

ANSWER: James Buchanan.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

- The Wall Street Journal, July 10, 2020

2. The Wall Street Journal, July 10, 2020

3. The Wall Street Journal, July 10, 2020

4. CNBC, July 7, 2020

5. MarketWatch, July 7, 2020

6. MarketWatch, July 7, 2020

CHART CITATIONS:

The Wall Street Journal, July 10, 2020

The Wall Street Journal, July 10, 2020

Treasury.gov, July 10, 2020