In this week’s recap: A Fed taper may loom; economic data mixed.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |August 23, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

Stocks turned lower last week amid the increasing probability of a Fed tapering, mixed economic data, and growing concerns about the economic impact of the Delta variant.

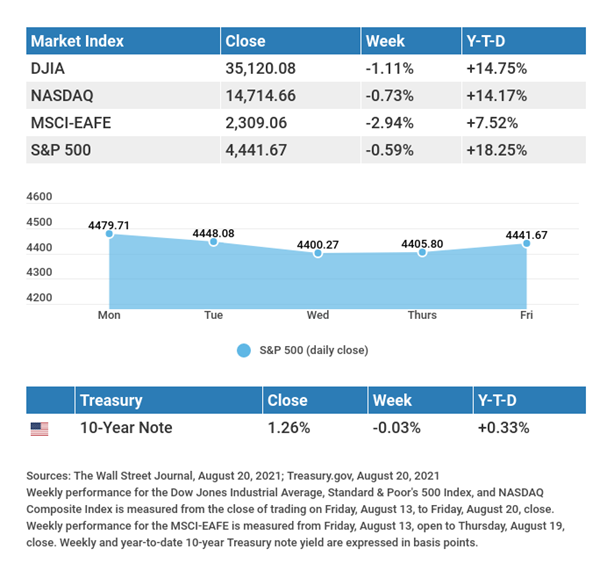

The Dow Jones Industrial Average slumped 1.11%, while the Standard & Poor’s 500 lost 0.59%. The Nasdaq Composite index slipped 0.73%. The MSCI EAFE index, which tracks developed overseas stock markets, surrendered 2.94%.1,2,3

UNSETTLING NEWS

After the Dow Industrials and S&P 500 index climbed to new record highs to begin the week, stocks pulled back amid weaker-than-expected retail sales, festering concerns about the Delta variant, and slowing growth in China.

The stock market retreat accelerated mid-week with the release of the FOMC (Federal Open Market Committee) meeting minutes, which signaled that Fed officials may be ready to begin reducing its monthly bond purchases before the end of the year. Stocks managed to stabilize on Friday, paring some of the week’s losses. Consumer staples, health care, real estate, and utilities were the top-performing groups.4

TAPER BY YEAR END?

Two weeks ago, multiple regional Federal Reserve Bank presidents suggested that the economy was strong enough to justify tapering the Fed’s monthly bond purchases.

Last week, that chorus grew a bit louder with the release of minutes from July’s FOMC (Federal Open Market Committee) meeting. The precise timing was left undecided, with some officials believing it should begin before year-end, while others thought waiting until the start of the new year was the better choice.5

TIP OF THE WEEK

The fine print on a lease or a mortgage is always worth reading. Ask the business owners and homeowners who have learned this from experience.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Existing Home Sales.PMI (Purchasing Managers’ Index) Composite Flash.

Tuesday: New Home Sales.

Wednesday: Durable Goods Orders.

Thursday: Jobless Claims. Gross Domestic Product (GDP).

Friday: Consumer Sentiment.

Source: Econoday, August 20, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: JD.com, Inc. (JD), Palo Alto Networks, Inc. (PANW).

Tuesday: Best Buy Co. (BBY), Intuit, Inc. (INTU).

Wednesday: Salesforce.com (CRM), Ulta Beauty, Inc. (ULTA), Autodesk, Inc. (ADSK).

Thursday: Marvell Technology, Inc. (MRVL), Workday, Inc. (WDAY), Dollar Tree (DLTR), Dell Technologies (DELL), VMware, Inc. (VMW), Peloton Interactive, Inc. (PTON).

Source: Zacks, August 20, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Every man is working out his destiny in his own way and nobody can be of any help except by being kind, generous, and patient.”

HENRY MILLER

THE WEEKLY RIDDLE

Aaron is the brother of Bob. Bob is the brother of Cody. Cody is the father of Dan. So how is Dan related to Aaron?

LAST WEEK’S RIDDLE: What three positive numbers give the same answer when multiplied or added together?

ANSWER: 1,2, and 3.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, August 20, 2021

- The Wall Street Journal, August 20, 2021

- The Wall Street Journal, August 20, 2021

- ALPS Portfolio Solutions, August 20, 2021

- Reuters.com, August 19, 2021