In this week’s recap: Stocks sink on rate hike talk.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |January 24, 2022

THE WEEK ON WALL STREET

Stocks extended their January retreat as worries over inflation and rising bond yields continued to exert downward pressure on prices.

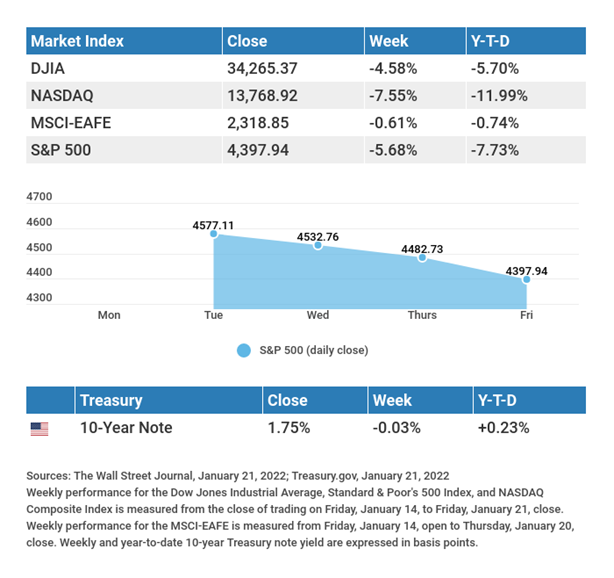

The Dow Jones Industrial Average slid 4.58%, while the Standard & Poor’s 500 sank 5.68%. The Nasdaq Composite index dropped 7.55% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.61%.1,2,3

ANOTHER TURBULENT WEEK

After the holiday weekend, stocks found little respite from this month’s selling pressures. The week began with the 10-year Treasury yield hitting a two-year high that triggered a broad retreat in stocks, with technology and other high-growth companies bearing the brunt of the losses. The Nasdaq Composite officially entered correction territory and closed below its 200-day moving average for the first time since April 2020.4

Stocks struggled throughout the week, rallying in early trading on both Wednesday and Thursday on solid corporate earnings and stabilizing bond yields, only to end lower on late-day selling. While last year may have been distinguished by “buying on the dip,” this week reflected a different mindset, “selling on the rebound.” Stocks extended their losses in the final hours of the Friday trading session to conclude a difficult week.

RATE HIKE EXPECTATIONS RISE

Recent market volatility has stemmed predominantly from inflation concerns and how aggressive the Fed will be in fighting it. This reaction reflects the market’s pricing of rate hike probabilities, and their estimation of the Fed’s reaction.

Last week’s interest rate futures suggested that investors expect four or five rate hikes this year, up from three to four the previous week. Markets are pricing a 32% probability of 4-5 rate hikes by December and a nearly 28% probability of 5-6 rate hikes by year-end. Of course, the Fed will act independently of the market, but it provides insight into the recent run-up in yields and continuing pressure on high-growth stock valuations.5,6

TIP OF THE WEEK

If a major financial or life event is coming up on your calendar, talk to a financial professional about it now. See what ideas they may have about how to manage the event.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Purchasing Managers’ Index (PMI) Composite Flash.

Tuesday: Consumer Confidence.

Wednesday: New Home Sales. FOMC Announcement.

Thursday: Gross Domestic Product (GDP). Durable Goods Orders. Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, January 21, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: International Business Machines (IBM).

Tuesday: Microsoft Corporation (MSFT), General Electric Company (GE), Verizon Communications, Inc. (VZ), Johnson & Johnson (JNJ), Lockheed Martin Corporation (LMT), Texas Instruments, Inc. (TXN), American Express Company (AXP), Capital One Financial Corporation (COF), Raytheon Technologies Corporation (RTX).

Wednesday: AT&T, Inc. (T), Intel Corporation (INTC), The Boeing Company (BA), Tesla, Inc. (TSLA), Abbott Laboratories (ABT), ServiceNow, Inc. (NOW), KimberlyClark Corporation (KMB), Norfolk Southern Corporation (NSC).

Thursday: Apple, Inc. (AAPL), Visa, Inc. (V), Mastercard, Inc. (MA), McDonald’s Corporation (MCD), Northrop Grumman Corporation (NOC), Blackstone, Inc. (BX), Southwest Airlines Co. (LUV), The SherwinWilliams Company (SHW), Mondelez International, Inc. (MDLZ).

Friday: Caterpillar, Inc. (CAT), Chevron Corporation (CVX), ColgatePalmolive Company (CL).

Source: Zacks, January 21, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Brass shines as fair to the ignorant as gold to the goldsmiths.”

ELIZABETH I

THE WEEKLY RIDDLE

A woman sailed into the Bahamas with her boat on the 28th of April. She stayed in the Bahamas for three weeks and then left in April. How is this possible?

LAST WEEK’S RIDDLE: How many times can you subtract the number 4 from 40?

ANSWER: Once. After that, you will no longer be working with the number 40.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, January 21, 2022

- The Wall Street Journal, January 21, 2022

- The Wall Street Journal, January 21, 2022

- CNBC, January 17, 2022

- The Wall Street Journal, January 18, 2022

- CME, January 19, 2022