In this week’s recap: Markets overcome reaction to latest Delta variant news.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |July 26, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

Overcoming a COVID-related economic growth scare, stocks moved higher amid a week of strong corporate earnings reports.

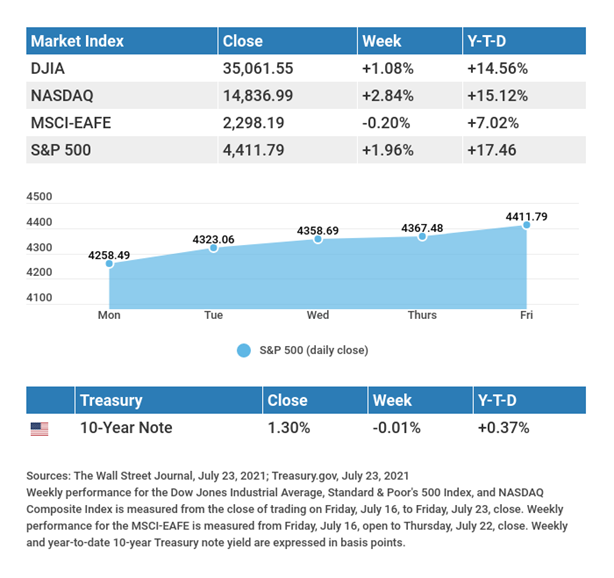

The Dow Jones Industrial Average rose 1.08%, while the Standard & Poor’s 500 gained 1.96%. The Nasdaq Composite index soared 2.84% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dipped 0.20%.1,2,3

DELTA VARIANT HEAD FAKE

Stocks staged a broad retreat on Monday as traders worried about the adverse economic implications of growing Delta variant infections. Economically sensitive sectors, such as energy, financials, industrials, and materials, absorbed the brunt of Monday’s sell-off.

But the markets did a quick about face, posting four-consecutive days of gains and leaving the three major averages with fresh record highs.4

The sharp reversal may be attributable to a “buy on the dip” investor mentality, the absence of investment alternatives to stocks in this low interest rate environment, and massive financial liquidity. Stocks were also lifted by a healthy kick-off to the second quarter earnings season.

STRONG START

The earnings season moved into full swing last week, and the results exceeded the market’s high expectations.

Of the 120 companies in the S&P 500 index that have reported as of Friday, July 23, 89% of them beat the Street’s earnings-per-share estimates by, on average, 20.6%. Financials and Consumer Discretionary sectors provided the biggest earnings surprises (+28.9% and +24.5%, respectively), while Materials and Utilities delivered the smallest positive surprises (+5.3% and +2.5%, respectively).

These earnings beats are leading Wall Street analysts to raise earnings estimates for 3Q 2021 through 1Q 2022.5

FINAL THOUGHT

The National Bureau of Economic Research said last week that the pandemic-induced recession ended in April 2020, officially lasting two months and making it the shortest recession in U.S. history.6

TIP OF THE WEEK

Each day brings breaking news; beware of abruptly altering your long-range financial strategy in response.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: New Home Sales.

Tuesday: Consumer Confidence. Durable Goods Orders.

Wednesday: FOMC (Federal Open Market Committee) Announcement.

Thursday: GDP (Gross Domestic Product). Jobless Claims.

Source: Econoday, July 23, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Tesla (TSLA), Lockheed Martin (LMT).

Tuesday: Apple, Inc. (AAPL), Microsoft Corporation (MSFT), General Electric (GE), Advanced Micro Devices, Inc. (AMD), Visa (V), Alphabet, Inc. (GOOGL), Starbucks Corporation (SBUX), 3M Company (MMM), United Parcel Service, Inc. (UPS), Mondelez International (MDLZ).

Wednesday: Facebook, Inc. (FB), The Boeing Corporation (BA), Qualcomm, Inc. (QCOM), Bristol Myers Squibb (BMY), Paypal Holdings (PYPL), Pfizer, Inc. (PFE), McDonalds Corporation (MCD), Shopify, Inc. (SHOP), Servicenow, Inc. (NOW), Thermo Fisher Scientific, Inc. (TMO).

Thursday: Amazon.com, Inc. (AMZN), Ford Motor Company (F), Mastercard (MA), Twilio, Inc. (TWLO), Merck & Company (MRK), The Southern Company (SO), Northrop Grumman (NOC), Comcast Corporation (CMCSA), AnheuserBusch InBev (BUD), Abbvie, Inc. (ABBV).

Friday: Exxon Mobil Corporation (XOM), Caterpillar, Inc.(CAT), Chevron Corporation (CVX), Procter & Gamble (PG), Charter Communications, Inc. (CHRT).

Source: Zacks, July 23, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“If you have passion, a chip on the shoulder, a sense of humor, and you can explain what you do very well, it doesn’t matter if you’re a plumber or a singer or a politician. If you have those four things, you are interesting.”

LARRY KING

THE WEEKLY RIDDLE

When can you add two to eleven and get one as the correct answer?

LAST WEEK’S RIDDLE: If you were running a race, and you passed the person in 2nd place, what place would you be in now?

ANSWER: 2nd place.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, July 23, 2021

- The Wall Street Journal, July 23, 2021

- The Wall Street Journal, July 23, 2021

- CNBC, July 23, 2021

- Earnings Scout, July 23, 2021

- The Wall Street Journal, July 19, 2021