In this week’s recap: Mixed signals lead to a choppy week.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |April 26, 2021

THE WEEK ON WALL STREET

The crosscurrents of strong corporate earnings, rising global cases of COVID-19, and the specter of higher capital gains taxes led to a choppy week of trading that left stock prices slightly lower for the week.

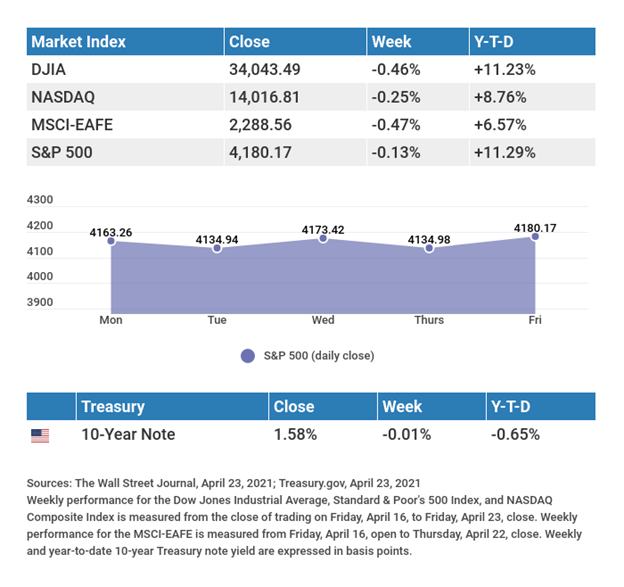

The Dow Jones Industrial Average lost 0.46%, while the Standard & Poor’s 500 slipped 0.13%. The Nasdaq Composite index fell 0.25% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 0.47%.1,2,3

A Directionless Week

Despite continued better-than-expected corporate earnings, stocks retreated as concerns over rising global COVID-19 infections weighed on investor sentiment. A mid-week rally erased much of these losses, with reopening stocks and small cap companies leading the market.

The stock market resumed its decline in reaction to reports that President Biden supported a capital gains tax increase on wealthy Americans. The Biden news prompted worries that stocks could come under pressure this year if such an increase were to go into effect next year.

Solid economic reports, along with a reassessment of the capital gains news, helped stocks to bounce back and close out the week on a positive note.

Housing Shows Strength

Two housing market reports last week reflected strong consumer demand for homes.

Sales of new homes in March jumped by 20.7% from February and by more than 66% from last March, reaching levels not seen since 2006. All regions recorded double-digit gains, except for the West, which experienced a decline of 30%.4

Though existing home sales fell 3.7%, it wasn’t for lack of consumer interest, as evidenced by the 18-day average to sell a home. The decline was largely an issue of tight inventories. This demand/supply imbalance drove median home prices higher by 17.2% from March 2020 to $329,100.5

TIP OF THE WEEK

Save your business money by buying furnishings and equipment at bankruptcy auctions, government sales, closeouts and furniture rental outlets.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Durable Goods Orders.

Tuesday: Consumer Confidence.

Wednesday: Federal Open Market Committee (FOMC) Announcement.

Thursday: Jobless Claims. Gross Domestic Product (GDP).

Source: Econoday, April 23, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Tesla, Inc. (TSLA).

Tuesday: Microsoft (MSFT), Advanced Micro Devices, Inc. (AMD), Visa (V), Alphabet, Inc. (GOOGL), Starbucks (SBUX), Amgen, Inc. (AMGN), Eli Lilly and Company (LLY), 3M Company (MMM), Texas Instruments (TXN), United Parcel Service (UPS), Mondelez International (MDLZ).

Wednesday: Apple, Inc. (AAPL), Facebook (FB), Boeing (BA), Ford Motor Company (F), Qualcomm (QCOM), Shopify, Inc. (SHOP), Servicenow, Inc. (NOW), Teladoc Health, Inc. (TDOC), Ebay (EBAY).

Thursday: Amazon.com (AMZN), Twitter, Inc. (TWTR), Mastercard (MA), Bristol Myers Squibb (BMY), Caterpillar, Inc. (CAT), Merck & Company (MRK), McDonald’s Corporation (MCD), Comcast Corporation (CMCSA), American Tower Corporation (AMT).

Friday: Abbvie, Inc (ABBV), Chevron (CVX), Charter Communications (CHTR).

Source: Zacks, April 23, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Optimism is the faith that leads to achievement.”

HELEN KELLER

THE WEEKLY RIDDLE

A certain month can begin on a Friday and end on a Friday as well. What month is it?

LAST WEEK’S RIDDLE: What number is 4 more than the number that is double one-fifth of one-tenth of 900?

ANSWER: 40 (900 / 10 = 90 / 5 = 18 x 2 = 36 + 4 = 40).

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, April 23, 2021.

- The Wall Street Journal, April 23, 2021

- The Wall Street Journal, April 23, 2021

- Yahoo! News, April 23, 2021

- CNBC, April 22, 2021