In this week’s recap: stocks rise, and consumer prices jump; COVID-19 cases slow; Congressional talks stall.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |August 17, 2020

Stock prices drifted higher in an otherwise quiet news week, as a slowdown in new COVID-19 cases outweighed a Congressional impasse on a new fiscal spending measure.

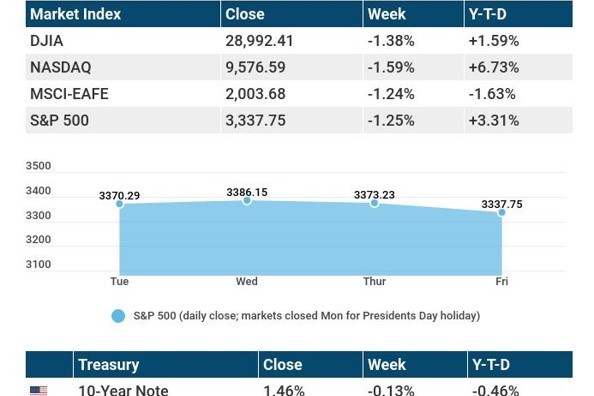

The Dow Jones Industrial Average gained 1.81%, while the Standard & Poor’s 500 rose by 0.64%. The Nasdaq Composite Index inched 0.08% higher for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, advanced 3.11%.1,2,3

S&P 500 Nears All-Time High

Stocks prices were supported by a falling rate of COVID-19 cases nationwide and optimism that – despite a lack of progress on a fiscal aid bill – Congress would eventually come to a spending agreement.4

The industrial and financial sectors saw solid gains, while technology stocks, after slipping earlier in the week, found some footing as the week came to a close.

The S&P 500 Index flirted all week with setting a new record high. At one point on Thursday, it traded above its February 2020 record close before closing slightly lower. Stocks treaded water into Friday, as Congress recessed for the summer.5

Consumer Prices Jump

On Wednesday, the Labor Department said that the Consumer Price Index rose 0.6% in July, matching the 0.6% increase in June. The increase was double the consensus estimate of 0.3%. The general view is that the acceleration in consumer prices is more indicative of a healing economy than the beginning of a cycle of higher inflation.6,7

The Fed does not appear concerned about these recent monthly price jumps. It remains more worried about disinflation. However, if inflation continues to pick up, the Fed may be forced to reconsider its COVID-19 monetary policy.8

TIP OF THE WEEK

Is your business structured to limit your liability? Your financial professional may be able to provide some insights about what business structures to consider.

Tuesday: Housing Starts.

Wednesday: Federal Open Market Committee (FOMC) Minutes.

Thursday: Jobless Claims. Index of Leading Economic Indicators.

Friday: Existing Home Sales.

Source: Econoday, August 14, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: JD.com (JD).

Tuesday: Walmart (WMT), The Home Depot (HD), Kohls (KSS).

Wednesday: Nvidia (NVDA), Target (TGT), Lowe’s (LOW).

Thursday: Alibaba Group (BABA).

Friday: John Deere (DE).

Source: Zacks, August 14, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Wise men make more opportunities than they find.”

SIR FRANCIS BACON

THE WEEKLY RIDDLE

What number should be next in this series: 9, 16, 25, 36?

LAST WEEK’S RIDDLE: Nancy was born in summer, yet she was born in January. How is this possible?

ANSWER: She was born in the southern hemisphere.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1. The Wall Street Journal, August 14, 2020

2. The Wall Street Journal, August 14, 2020

3. The Wall Street Journal, August 14, 2020

4. CNBC, August 12, 2020

5. CNBC, August 13, 2020

6. The Wall Street Journal, August 12, 2020

7. The Wall Street Journal, August 12, 2020

8. CNBC, August 12, 2020

CHART CITATIONS:

The Wall Street Journal, August 14, 2020

The Wall Street Journal, August 14, 2020

treasury.gov, August 14, 2020