In this week’s recap: Despite Delta variant fears, stocks rise on strong jobs, strong earnings reports.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |August 9, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

Overcoming jitters about the Delta variant and the reintroduction of mask requirements, stocks climbed higher on strong employment data and a fresh batch of strong corporate earnings.

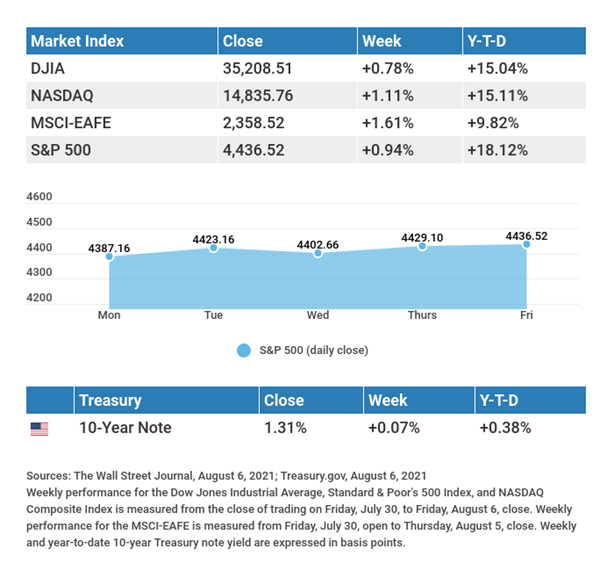

The Dow Jones Industrial Average rose 0.78% while the Standard & Poor’s 500 advanced 0.94%. The Nasdaq Composite index gained 1.11% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, picked up 1.61%.1,2,3

PUSH AND PULL

The crosscurrents of strong corporate profits and the rise in Delta variant infections led to a roller coaster week of price action, as markets alternated between daily gains and losses. By Thursday, however, investors appeared to grow more optimistic that the economic reopening was not under serious threat when back-to-back employment reports suggested that the economic recovery remained on track.

A favorable initial jobless claims report was enough to send the S&P 500 and Nasdaq to new all-time highs. Thanks to Friday’s stronger-than-expected employment report, the S&P 500 managed to add to its previous record close, while the Dow Jones Industrial Average set its own record high. The more tech-centric Nasdaq, however, slipped off its highs.4

EMPLOYMENT BRIGHTENS

Last week reinforced the idea of an improving labor market. After a disappointing ADP (Automated Data Processing) National Employment Report that showed a slowdown in private-sector hiring, with just 330,000 new jobs added, subsequent employment data were much more encouraging.5

Thursday’s report of a modest drop in initial jobless claims to 385,000 and a more substantial drop of 366,000 in continuing claims was followed by a solid employment report on Friday, which showed employers had added 943,000 new jobs in July—the biggest jump since August 2020. This hiring increase shaved the unemployment rate to 5.4%, down from June’s 5.9% rate.6,7

TIP OF THE WEEK

Most homeowner insurance policies do not cover damage from floods and earthquakes. You will need to purchase separate coverage for protection from those calamities.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: JOLTS (Job Openings and Labor Turnover Survey).

Wednesday: Consumer Price Index.

Thursday: Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, August 6, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Air Products and Chemicals, Inc. (APD), Tyson Foods, Inc. (TSN).

Tuesday: Sysco Corporation (SYY), Coinbase Global, Inc. (COIN).

Wednesday: Nio, Inc. (NIO), eBay, Inc. (EBAY).

Thursday: The Walt Disney Company (DIS), Baidu, Inc. (BIDU), Doordash, Inc. (DASH), Airbnb, Inc. (ABNB).

Source: Zacks, August 6, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Do not merely practice your art, but force your way into its secrets; it deserves that, for only art and science can exalt man to divinity.”

LUDWIG VAN BEETHOVEN

THE WEEKLY RIDDLE

What has exactly three feet, but not a single toe?

LAST WEEK’S RIDDLE: A coin lies inside an otherwise empty bottle that has a cork inserted in its neck. How can you remove this coin without removing the cork or breaking the bottle?

ANSWER: Push the cork into the bottle, then turn the bottle upside down to let the coin out.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, August 6, 2021

- The Wall Street Journal, August 6, 2021

- The Wall Street Journal, August 6, 2021

- CNBC, August 6, 2021

- CNBC, August 4, 2021

- The Wall Street Journal, August 5, 2021

- The Wall Street Journal, August 6, 2021