In this week’s recap: Fed tightens money policy.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |December 20, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

Stock prices retreated last week as global central banks joined the Federal Reserve in taking steps to tighten monetary policy.

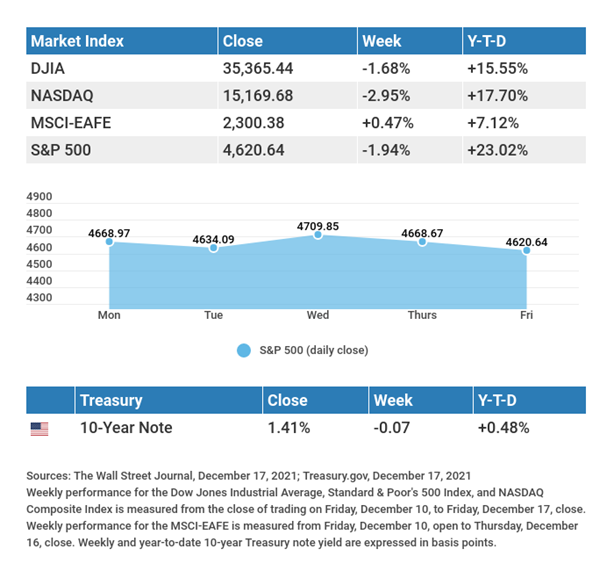

The Dow Jones Industrial Average fell 1.68%, while the Standard & Poor’s 500 dropped 1.94%. The Nasdaq Composite index tumbled 2.95% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, managed a gain of 0.47%.1,2,3

FROM UNCERTAIN TO UNSETTLED

Stocks weakened ahead of Wednesday’s Federal Open Market Committee (FOMC) meeting as investors weighed how aggressive the Fed might be in reversing its easy-money policies. Investor sentiment was further dented by disappointing economic data. Retail sales fell short of expectations and a year-over-year jump of 9.6% in producer prices reflected price pressures that may translate into higher future consumer prices. It was the highest percentage increase since records started in 2010.4

The market initially responded well to the FOMC announcement on Wednesday afternoon, but became unsettled into Thursday and Friday over a tighter monetary policy and Omicron concerns.

A NEW FED NARRATIVE

After the FOMC meeting, the Fed announced a plan to quicken the tapering of its monthly bond purchases. It plans to double the rate from $15 billion a month (announced in November) to $30 billion a month, effectively putting an end to asset purchases by March 2022. The Fed also signaled that as many as three rate hikes may be coming in 2022.5

The Fed cited elevated inflation and an improved labor market as justification for the pivot from its pandemic-related, easy-money policies. Reflecting the persistence of higher-than-anticipated inflation, the Fed raised its previous inflation estimates for this year and 2022.6

FINAL NOTE

Our weekly market commentary will not be published next week. We want to take this opportunity to wish you and your family a wonderful holiday season and a very happy and prosperous new year!

TIP OF THE WEEK

Ward off impulse buying with a 30-day list. If you feel like you have to have something, put it on your 30-day list. See if you still have the urge to buy it after 30 days; chances are, you won’t.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Index of Leading Economic Indicators. FOMC (Federal Open Market Committee) Announcement.

Wednesday: GDP (Gross Domestic Product). Consumer Confidence. Existing Home Sales.

Thursday: Durable Goods Orders. Jobless Claims. New Home Sales. Consumer Sentiment.

Source: Econoday, December 17, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Micron Technology, Inc. (MU), Nike, Inc. (NKE).

Tuesday: General Mills, Inc. (GIS).

Wednesday: Cintas Corporation (CTAS), Paychex, Inc. (PAYX).

Source: Zacks, December 17, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Keep your thoughts free from hate, and you need have no fear from those who hate you.”

GEORGE WASHINGTON CARVER

THE WEEKLY RIDDLE

Tim hands a friend $63 using six bills, none of which are dollar bills. How is he able to do this?

LAST WEEK’S RIDDLE: I never ask you questions, yet you answer me all the time. What am I?

ANSWER: A phone.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding a ny Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economi c instability and differences in accounting standards. This material represents an assessment of the market environment at a specif ic point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any p erson or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

- The Wall Street Journal, December 17, 2021

- The Wall Street Journal, December 17, 2021

- The Wall Street Journal, December 17, 2021

- The Wall Street Journal, December 14, 2021

- The Wall Street Journal, December 15, 2021

- The Wall Street Journal, December 15, 2021