In this week’s recap: Despite continued COVID-19 woes and unrest in Washington D.C., the stock market starts 2021 on a high.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |January 11, 2021

THE WEEK ON WALL STREET

Shrugging off COVID-19 infections and the disruption at the Capitol on January 6, stocks powered higher to kick off a new year of trading.

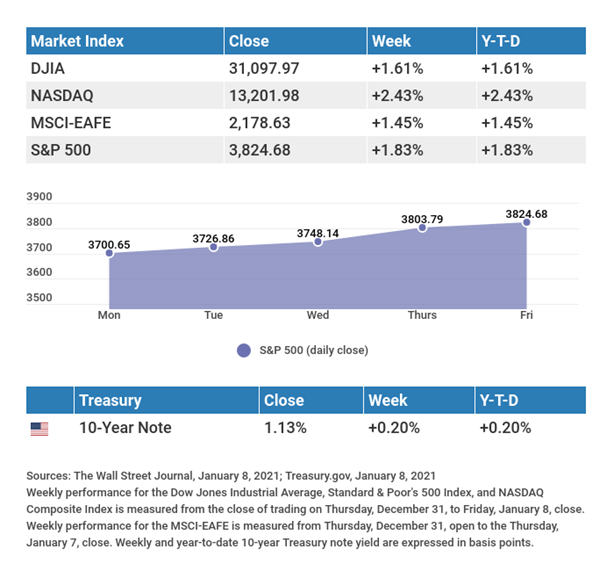

The Dow Jones Industrial Average gained 1.61%, while the Standard & Poor’s 500 increased by 1.83%. The Nasdaq Composite index, which led throughout 2020, picked up 2.43%. The MSCI EAFE index, which tracks developed overseas stock markets, rose 1.45%.1,2,3

Fireworks to Start the New Year

Stocks got off to an inauspicious start amid the stuttering pace of vaccine distribution and concern that the economic recovery might take longer than anticipated. Uncertainty over the looming Senate runoff election in Georgia added to the broad retreat that marked the first day of 2021 trading.

From there markets turned higher, aided by firming oil prices with subsequent support provided by the Georgia Senate election results, which lifted hopes of additional fiscal stimulus. Stocks managed through political unrest mid-week, with banks, economically sensitive stocks, and technology shares leading the way.

The yield on the 10-year Treasury rose above 1% for the first time since March as investors fled bonds in anticipation of new federal borrowing.4

Stocks touched all-time highs on the final trading day, capping a strong week of performance.5

Employment Picture

The U.S. economy lost 140,000 jobs in December, confirming fears of economic slowdown brought on by a resurgence of COVID-19 infections.

Not surprisingly, it was restaurants and bars that saw the greatest job losses, with the larger hospitality sector accounting for nearly all the job losses last month. Meanwhile, November job creation was revised upward, from 245,000 to 336,000.6

To help put the pandemic in perspective, December’s job report capped the worst year for job losses since the tracking began in 1939. The unemployment rate remained unchanged at 6.7%.7

TIP OF THE WEEK

When it comes to couples and money, a strategy is better than an assumption. Discuss your financial goals together and stick to the approach you make to pursue them.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Consumer Price Index (CPI).

Thursday: Initial Jobless Claims.

Friday: Retail Sales, Consumer Sentiment, Industrial Production.

Source: Econoday, January 8, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: KB Home (KBH).

Thursday: Blackrock (BLK).

Friday: JPMorgan Chase (JPM), Citigroup (C), PNC Financial (PNC).

Source: Zacks, January 8, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Fun is a good thing, but only when it spoils nothing better.”

GEORGE SANTAYANA

THE WEEKLY RIDDLE

Yesterday was Wednesday’s tomorrow. Tomorrow is Sunday’s yesterday. Given those circumstances, what day would today be?

LAST WEEK’S RIDDLE: The railings on a 60-yard-long walkway have ornamental sculptures every 12 yards on both sides, starting at the east and west ends of the walkway. How many total sculptures are there on the walkway?

ANSWER: 12 sculptures total, as there are 6 per side if they occur every 12 yards (0-12-24-36-48-60).

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, January 8, 2021

- The Wall Street Journal, January 8, 2021

- The Wall Street Journal, January 8, 2021

- The Wall Street Journal, January 6, 2021

- CNBC, January 8, 2021

- The Wall Street Journal, January 8, 2021

- The Wall Street Journal, January 8, 2021