In this week’s recap: Mixed news elicits a mixed reaction from the markets; incoming Biden Administration outlines stimulus plan.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |January 18, 2021

THE WEEK ON WALL STREET

Markets drifted lower last week as uninspired investors digested mixed news on the economic front.

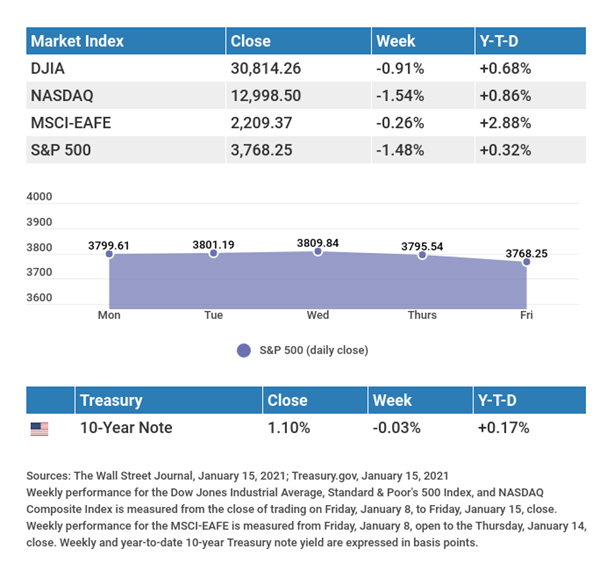

The Dow Jones Industrial Average lost 0.91% while the Standard & Poor’s 500 slid 1.48%. The Nasdaq Composite index stumbled 1.54% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.26%.1,2,3

Stocks Drift Lower

Stocks traded without much conviction last week, pushed lower, in part, by a broad retreat in technology. Rising interest rates also dampened enthusiasm, feeding concerns over their effect on current stock valuations.

Markets seemed deaf to a stream of news, moving little on the House impeachment vote, encouraging news on the vaccine front, reassurances from Fed Chair Powell, or a jump in jobless claims. Energy and financials continued their recent advance, while smaller capitalization stocks rose on expectations of becoming beneficiaries of any stimulus bill.4,5

Stocks turned lower to close the week, following the unveiling of president-elect Biden’s stimulus plan and a weaker-than-expected retail sales number.6

New Stimulus Proposal

Biden revealed his long-anticipated stimulus proposal last week, announcing a $1.9 trillion spending plan to provide further help to an unsteady economy.

Along with monetary easing, fiscal stimulus has been one of the major drivers of the stock market recovery, which is why investors have anxiously awaited his plan.

His proposal seeks to help individuals, including direct payments for qualifying Americans and enhanced unemployment aid. The proposal would also include help for small businesses with a new grant program in addition to the Paycheck Protection Program, and would bolster state finances by funding frontline workers, vaccine distribution, reopening schools, and vital services.

The market reaction was muted. Investors will be watching the extent to which Congress amends Biden’s proposal and the speed at which it’s picked up by the legislature.

TIP OF THE WEEK

If you are getting married and want to buy a home, consider setting up a wedding registry that collects money specifically for a down payment.

THE WEEK AHEAD: KEY ECONOMIC DATA

Thursday: Housing Starts. Jobless Claims.

Friday: Existing Home Sales. PMI (Purchasing Managers’ Index) Composite Flash.

Source: Econoday, January 15, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Netflix (NFLX), Bank of America (BAC), Goldman Sachs (GS), J.B. Hunt Transportation (JBHT).

Wednesday: UnitedHealth Group (UNH), Morgan Stanley (MS), United Airlines (UAL).

Thursday: IBM (IBM), CSX Corporation (CSX), Union Pacific (UNP).

Friday: Kansas City Southern (KSU), PPG Industries (PPG).

Source: Zacks, January 15, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“We can only be said to be alive in those moments when our hearts are conscious of our treasures.”

THORNTON WILDER

THE WEEKLY RIDDLE

Four cars approach an intersection with four-way stop signs simultaneously, each car coming from a different direction. After stopping, the drivers all accelerate at the same time. However, there is no accident. How is this possible?

LAST WEEK’S RIDDLE: Yesterday was Wednesday’s tomorrow. Tomorrow is Sunday’s yesterday. Given those circumstances, what day would today be?

ANSWER: Friday.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, January 15, 2021

- The Wall Street Journal, January 15, 2021

- The Wall Street Journal, January 15, 2021

- CNBC.com, January 14, 2021

- Yahoo.Finance.com, January 14, 2021

- The Wall Street Journal, January 15, 2021