In this week’s recap: U.S. equity benchmarks hit fresh record highs; one trade deal is signed, and Congress approves another; builders break ground on more residential projects.

Weekly Market Commentary |Presented by Sterling Wealth Advisors | January 20, 2020

Traders were in an upbeat mood last week, reacting to news out of Washington: the signing of the phase-one trade deal between the U.S. and China as well as the Senate passage of the U.S.-Mexico-Canada Agreement (USMCA). In addition, a new earnings season started. Risk appetite grew and spurred all three of the major Wall Street averages to record settlements on Friday.1

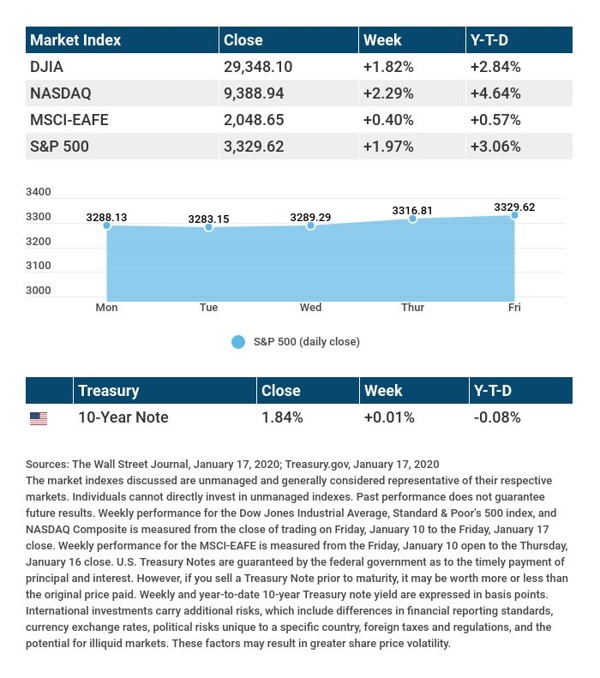

For the week, the Nasdaq Composite rose 2.29%; the S&P 500, 1.97%; the Dow Jones Industrial Average, 1.82%. International stocks improved 0.40%, according to MSCI’s EAFE index.2,3

Progress on the Trade Front

President Donald Trump and Chinese Vice Premier Liu He signed off on a new, partial U.S.-China trade pact Wednesday. In this deal, China agrees to buy at least $200 billion more of American products, crops, and energy futures over a 2-year period, and it must submit an “action plan” by mid-February, detailing how it will better protect American intellectual property and cut counterfeiting of American goods. The U.S. agrees to halve 15% tariffs on $120 billion of Chinese imports (other tariffs slated for last December were scrapped earlier as part of this agreement).

As for the USMCA, President Trump is expected to sign it into law this week. It was passed 89-10 in the Senate on Thursday, and by a wide margin in the House of Representatives in December. Mexico’s government has also approved the USMCA; Canada’s government has yet to do so.4,5

Homebuilding Picks Up

The Census Bureau reported a 16.9% surge in housing starts in December. This surpassed expectations; housing market analysts, surveyed by Refinitiv, had expected no increase.1

What’s AHEAD

U.S. stock markets are closed Monday, in observance of Martin Luther King Jr. Day. Post offices and Social Security offices will also be closed Monday as well as most banks.

TIP OF THE WEEK

A retirement relocation to a cheaper metro area may cost you money in the short run, but you might see considerable long-term savings from such a move.

Wednesday: December existing home sales figures from the National Association of Realtors.

Source: MarketWatch, January 17, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Capital One (COF), Netflix (NLFX), TD Ameritrade (AMTD), United Airlines (UAL)

Wednesday: Abbott Labs (ABT), Johnson & Johnson (JNJ), Texas Instruments (TXN)

Thursday: Comcast (CMCSA), Intel (INTC), Procter & Gamble (PG), Union Pacific (UNP)

Friday: American Express (AXP), Nextera Energy (NEE)

Source: Zacks, January 17, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“A joyful life is an individual creation that cannot be copied from a recipe.”

Mihaly Csikszentmihalyi

THE WEEKLY RIDDLE

Travel a mile, and I will change. Travel a million miles, and I might be incapable of further change. What am I?

LAST WEEK’S RIDDLE: I can be used to build castles, but I crumble in your hands. I can help a man see, and am found all around the lands. What am I?

ANSWER: Sand.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Wealth Advisors and Cambridge are not affiliated.

To learn more about Sterling Wealth Advisors, visit us on the web at www.sterlingwealthadvisorstx.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1 – foxbusiness.com/markets/us-stocks-jan-17-2020 [1/17/20]

2 – wsj.com/market-data [1/17/20]

3 – quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [1/17/20]

4 – cnbc.com/2020/01/15/trump-and-china-sign-phase-one-trade-agreement.html [1/16/20]

5 – washingtonpost.com/us-policy/2020/01/16/senate-approves-new-usmca-trade-deal-with-canada-mexico/ [1/16/20]

CHART CITATIONS:

wsj.com/market-data [1/17/20]

quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [1/17/20]

quotes.wsj.com/index/SPX/historical-prices [1/17/20]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [1/17/20]