In this week’s recap: Stocks edge higher in short week

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |July 12, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

Stocks managed small gains as investors wrestled with concerns over economic growth prospects and a rise in COVID-19 infections.

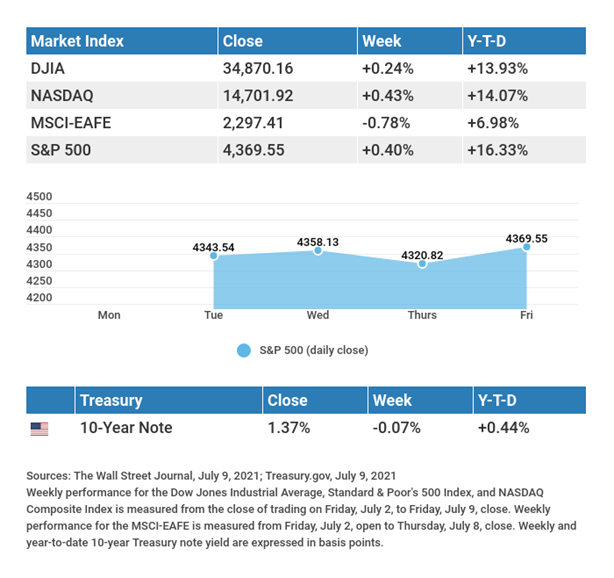

The Dow Jones Industrial Average picked up 0.24%, while the Standard & Poor’s 500 gained 0.40%. The Nasdaq Composite index added 0.43%. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.78%.1,2,3

A CHOPPY WEEK

In a truncated week of trading, stock market action was turbulent and indecisive. A mixed start saw cyclical stocks sell off amid concerns of slowing economic growth, while growth stocks advanced in response to falling yields.

After strengthening mid-week with the release of the FOMC meeting minutes, stocks skidded when reopening fears resurfaced Thursday on a new wave of global COVID-19 infections and Japan’s emergency declaration that reintroduced lockdown protocols. This led to a broad-based sell-off, with financials, home builders, and technology hit hard. A drop in bond yields added to the deteriorating sentiment.

Bond yields rebounded on Friday, setting the stage for a strong comeback for stocks, with the three major indices closing at new all-time highs.4

ATTENTION TURNS TO BONDS

Since reaching a 2021 high of 1.74% in March, the 10-year Treasury yield has been in a slow, steady decline, closing at 1.37% on Friday.5

One explanation may be that reopening sentiment has turned more cautious as the Delta variant of COVID-19 spreads globally. Another view is that overseas investors are buying Treasuries, effectively lowering yields.

Perhaps it’s abating inflation concerns, or simply excess liquidity finding its way into bonds. Whatever the message, the yield narrative has changed from just a few months ago when it was believed that the 10-year treasury was heading to two percent.5

TIP OF THE WEEK

If you are between 40 and 60 and need to build greater retirement savings, consider prioritizing that over paying for your children’s college expenses.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Consumer Price Index (CPI).

Thursday: Jobless Claims. Industrial Production.

Friday: Retail Sales.

Source: Econoday, July 9, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: JPMorgan Chase (JPM), Goldman Sachs (GS), Wells Fargo & Co. (WF), Pepsico, Inc. (PEP).

Wednesday: Bank of America (BAC), Citigroup, Inc. (C), Delta Airlines (DAL), Blackrock, Inc. (BLK).

Thursday: UnitedHealth Group (UNH), Morgan Stanley (MS), Taiwan Semiconductor (TSM).

Friday: Charles Schwab (SCHW), Kansas City Southern (KSU).

Source: Zacks, July 9, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“One does not fall “in” or “out” of love. One grows in love.”

LEO BUSCAGLIA

THE WEEKLY RIDDLE

It can be as round as a dishpan, as deep as a tub, and still the oceans couldn’t fill it up. What is it?

LAST WEEK’S RIDDLE: What 11-letter word must always be spelled incorrectly?

ANSWER: Incorrectly.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, July 9, 2021

- The Wall Street Journal, July 9, 2021

- The Wall Street Journal, July 9, 2021

- CNBC, July 9, 2021

- U.S Department of Treasury, July 9, 2021