In this week’s recap: despite continued COVID-19 concerns, markets react positively to upbeat economic data.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |July 6, 2020

In a holiday-shortened week, stock prices turned higher as encouraging economic data outweighed an increase in COVID-19 cases and a rollback in economic re-openings.

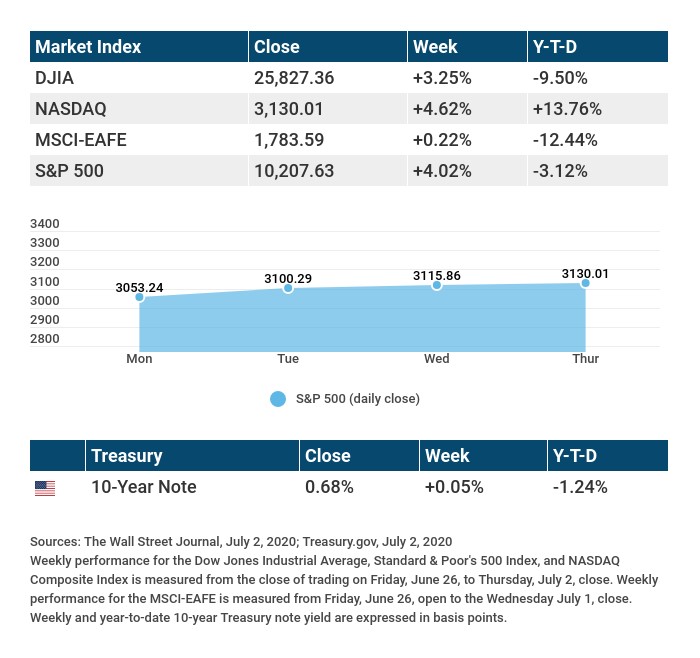

The Dow Jones Industrial Average rose 3.25%, while the Standard & Poor’s 500 increased by 4.02%. The Nasdaq Composite Index gained 4.62% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, picked up 0.22%.1,2,3

Stocks Climb a Wall of Worry

Stock prices moved higher on optimism of continued central bank support and a wave of buying on the final trading days of the second-calendar quarter.

On Wednesday, investors were emboldened by news of promising results from a COVID-19 vaccine trial. Stocks continued their move to the upside on Thursday, sparked by a better-than-expected jobs report and a higher-than-expected read on manufacturing activity.

Jobs, Jobs, Jobs

The ultimate measure of economic recovery is jobs for Americans, and last week, Wall Street got an update from three different perspectives.

First, the ADP (Automatic Data Processing) National Employment Report, which reported private-sector employers added 2.37 million jobs in June. Next, an update on jobless claims, which showed 1.43 million claims, slightly higher than estimates. And finally, the June employment report from the Bureau of Labor Statistics, which showed 4.8 million jobs added, and the unemployment rate falling to 11.1%. Both numbers were better than expected.4,5,6

While the employment numbers painted a mostly positive picture, it’s important to remember that the June wave of rehiring was prior to the increase in COVID-19 cases, which has caused some states to revisit their re-opening plans.

TIP OF THE WEEK

Sell old stuff to fund a new experience. Sell what you don’t need online and use the proceeds to partly or fully fund your new adventure.

Monday: Purchasing Managers Index (PMI) Services Index. Institute for Supply Management (ISM) Non-Manufacturing Index.

Tuesday: Job Openings and Labor Turnover Survey (JOLTS).

Thursday: Jobless Claims.

Source: Econoday, July 2, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Paychex (PAYX), Levi Strauss (LEVI).

Wednesday: Bed, Bath & Beyond (BBBY).

Thursday: Delta Airlines (DAL), Walgreens Boots (WBA).

Source: Zacks, July 2, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Service is the rent we pay to be living. It is the very purpose of life and not something you do in your spare time.”

MARION WRIGHT EDELMAN

THE WEEKLY RIDDLE

To date, only one bachelor has served as President of the United States. Can you name him?

LAST WEEK’S RIDDLE: Can you determine the numeral between 1 and 100 that is also nine times the sum of its digits?

ANSWER: 81. (8+1 = 9, 81 is 9x the sum of 9)

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1. The Wall Street Journal, July 2, 2020

2. The Wall Street Journal, July 2, 2020

3. The Wall Street Journal, July 2, 2020

4. MarketWatch, July 1, 2020

5. CNBC, July 2, 2020

6. The Wall Street Journal, July 2, 2020

CHART CITATIONS:

The Wall Street Journal, July 2, 2020

The Wall Street Journal, July 2, 2020

Treasury.gov, July 2, 2020