In this week’s recap: The Fed signals interest rate hikes.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |June 21, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

New messaging from the Federal Reserve on interest rates and inflation last week led to a broad retreat in stock prices.

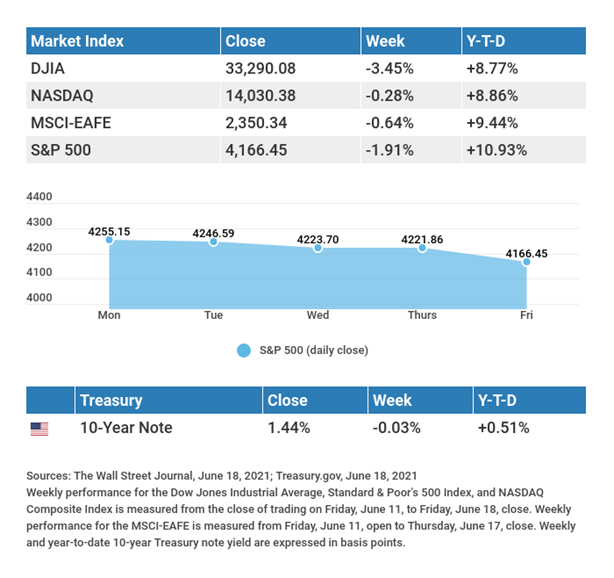

The Dow Jones Industrial Average dropped 3.45% while the Standard & Poor’s 500 lost 1.91%. The Nasdaq Composite index slipped 0.28% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 0.64%.1,2,3

UNSETTLED MARKETS

The Federal Reserve’s announcement on Wednesday that interest rate hikes may likely occur sooner than expected and that it had underestimated the pace of inflation unsettled investors. The hardest hit groups were cyclical stocks, like energy, materials, and industrials, as well as financials and consumer staples.4

Losses accelerated into the week’s close on comments by St. Louis Fed President James Bullard that the first rate hike could be as soon as 2022.

The bond yield curve flattened, as short-term interest rates rose in anticipation of rising rates and longer-term rates declined, reflecting a view of an eventual economic slowdown.

THE FED’S SURPRISE

Last week’s FOMC meeting announcement took investors by surprise as the Fed indicated that two rate hikes in 2023 were likely. It was as recent as March that the Fed had signaled that rates would remain unchanged until 2024.4

The Fed also raised its inflation expectations to 3.4%, up from its March projection of 2.4%, though it continues to believe that price increases will be transitory in nature.5

The Fed provided no indication of when and by how much it might begin tapering its monthly bond purchase program.6

TIP OF THE WEEK

You likely have multiple credit cards. Arrange them so that the one with the lowest interest rate is the easiest to reach for in your handbag or wallet.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Existing Home Sales.

Wednesday: PMI (Purchasing Managers Index) Composite Flash. New Home Sales.

Thursday: GDP (Gross Domestic Product). Durable Goods Orders. Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, June 18, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: KB Home (KBH).

Thursday: FedEx Corporation (FDX).

Friday: Carmax, Inc. (KMX).

Source: Zacks, June 18, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Done is better than perfect.”

SHERYL SANDBERG

THE WEEKLY RIDDLE

Before Mt. Everest was measured, in 1819, what was the highest mountain on earth?

LAST WEEK’S RIDDLE: What common English word has three consecutive double letters?

ANSWER: Bookkeeper.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, June 18, 2021

- The Wall Street Journal, June 18, 2021

- The Wall Street Journal, June 18, 2021

- CNBC, June 16, 2021

- The Wall Street Journal, June 16, 2021

- The Wall Street Journal, June 16, 2021