In this week’s recap: Stocks reach all-time highs and the housing market showed significant improvement.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |June 28, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

Stocks reached new all-time highs last week as markets staged a strong rebound from the previous week’s declines.

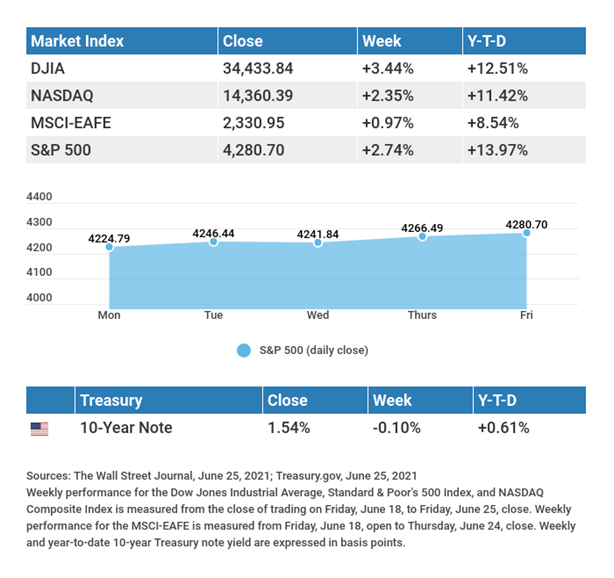

The Dow Jones Industrial Average rose 3.44%, while the Standard & Poor’s 500 picked up 2.74%. The Nasdaq Composite index increased 2.35%. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.97%.1,2,3

STOCKS CLIMB

Stocks rallied on the first day of trading last week and gained further momentum on Thursday and Friday. Despite some discouraging data on housing and initial jobless claims, stocks managed to set new highs, as investors cheered an agreement between President Biden and a group of senators that appeared to pave the way for the passage of a $1 trillion infrastructure bill.4

Positive results from the Federal Reserve’s stress tests of banks, which raised the prospect of banks raising their dividend payouts and share buybacks, and a key inflation measure coming in at market expectations provided impetus for further gains. The S&P 500 had its best week since February and ended the five-trading days at a record high.5

HOUSING HEADWINDS

Historically low mortgage rates, the COVID-19 pandemic, and a flush consumer have contributed to a very strong housing market in recent months. Last week’s housing data for May, however, showed that housing may be running into headwinds. The rising cost of materials and labor led to a 5.9% decline in new single home sales in May even as the median price hit an all-time high.6

Meanwhile, sales of existing homes fell 0.9%, the fourth-straight month of declines, owing to a very low inventory. High demand, coupled with a depressed supply, led to a 23.6% increase in the median price of an existing home.7

TIP OF THE WEEK

Double-check that your legal documents (your will, power of attorney, and trusts) are appropriately titled.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Consumer Confidence.

Wednesday: ADP (Automated Data Processing) Employment Report.

Thursday: Jobless Claims. ISM (Institute of Supply Management) Manufacturing Index.

Friday: Employment Situation Report. Factory Orders.

Source: Econoday, June 25, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Micron Technology, Inc. (MU), Constellation Brands, Inc. (STZ), General Mills, Inc. (GIS).

Thursday: Walgreens Boots Alliance, Inc. (WBA), McCormick & Company, Inc. (MKC).

Source: Zacks, June 25, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Lasting change is a series of compromises. And compromise is all right, as long your values don’t change.”

JANE GOODALL

THE WEEKLY RIDDLE

Can you write down eight eights so that they add up to one thousand?

LAST WEEK’S RIDDLE: Before Mt. Everest was measured, in 1819, what was the highest mountain on earth?

ANSWER: Mt. Everest was the highest – it simply hadn’t been measured yet.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, June 25, 2021

- The Wall Street Journal, June 25, 2021

- The Wall Street Journal, June 25, 2021

- CNBC, June 23, 2021

- CNBC, June 23, 2021

- Fox Business, June 23, 2021

- CNBC, June 22, 2021