In this week’s recap: A week of ups and downs leaves modest losses at week’s end.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |March 22, 2021

THE WEEK ON WALL STREET

Rising bond yields and improving economic conditions led to a choppy week of trading that ended in modest losses for investors.

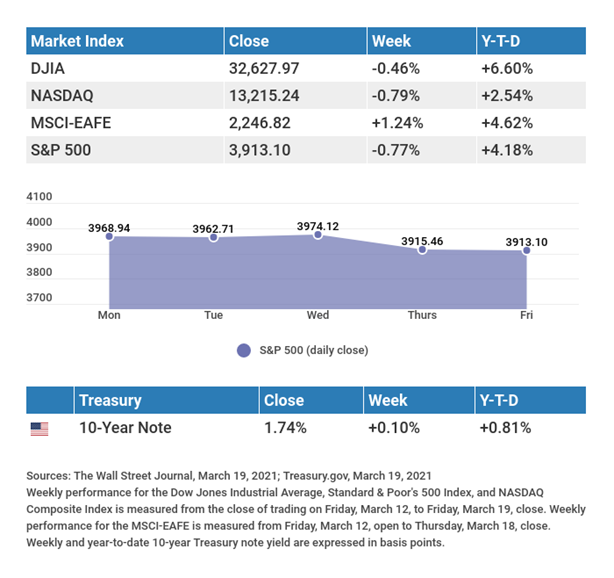

The Dow Jones Industrial Average fell 0.46%, while the Standard & Poor’s 500 declined 0.77%. The Nasdaq Composite index lost 0.79% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 1.24%.1,2,3

Rising Yields

The stock market began the week on a positive note, rising on optimism over the economic reopenings and a decline in bond yields. Technology shares staged a strong turnaround from the previous week.

Following the FOMC (Federal Open Market Committee) meeting announcement reaffirming the Fed’s easy-money policies, the Dow Industrials and the S&P 500 recorded new record closing highs.4

Markets reversed themselves on Thursday as a surge in yields sent technology and other high-growth stocks lower. During the session, the 10-year Treasury yield moved above 1.75% (the highest in 14 months), and the 30-year Treasury breached 2.5% for the first time since August 2019.5

Stocks closed out the week mixed as technology reclaimed some of the previous day’s losses.

The Fed Stands Pat

The Fed restated its commitment to no interest rate hikes through 2023. As expected, the FOMC also voted to continue its monthly bond purchases of at least $120 billion.

FOMC members projected that the economy would grow 6.5% this year, a sharp improvement over its previous estimate of a 4.2% gain. The forecast for the unemployment rate by year-end is 4.5%, down from the current rate of 6.2%. While Fed Chair Powell said that he anticipates inflation rising this year, he expects price increases to be temporary, with inflation staying within the Fed’s 2% target for the next several years.6

TIP OF THE WEEK

If you are 60 now, there is a reasonable chance that you may live into your eighties or nineties. So, with longevity in mind, prepare for retirement with wealth accumulation and wealth protection in mind.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Existing Home Sales.

Tuesday: New Home Sales.

Wednesday: Durable Goods Orders. Purchasing Managers’ Index (PMI) Composite Flash.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, March 19, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Adobe, Inc. (ADBE), Gamestop Corporation (GME).

Wednesday: General Mills (GIS).

Thursday: Darden Restaurants, Inc. (DRI).

Source: Zacks, March 19, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“It is good to have an end to journey toward; but it is the journey that matters, in the end.”

URSULA K. LE GUIN

THE WEEKLY RIDDLE

I have no heart or mind, but I do have two legs. Yet they only touch the ground when I am not carrying things around. What am I?

LAST WEEK’S RIDDLE: Where does today come before yesterday?

ANSWER: In the dictionary.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, March 19, 2021

- The Wall Street Journal, March 19, 2021

- The Wall Street Journal, March 19, 2021

- CNBC, March 17, 2021

- CNBC, March 18, 2021

- CNBC, March 17, 2021