In this week’s recap: New COVID-19 infections drive market anxieties, despite anticipated vaccines; Fed Chair Powell warns that continued infections may limit economic activity for months.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |November 23, 2020

THE WEEK ON WALL STREET

Despite news of another COVID-19 vaccine candidate, stocks were mixed amid investor anxiety over an increase in new infections and economic lockdowns.

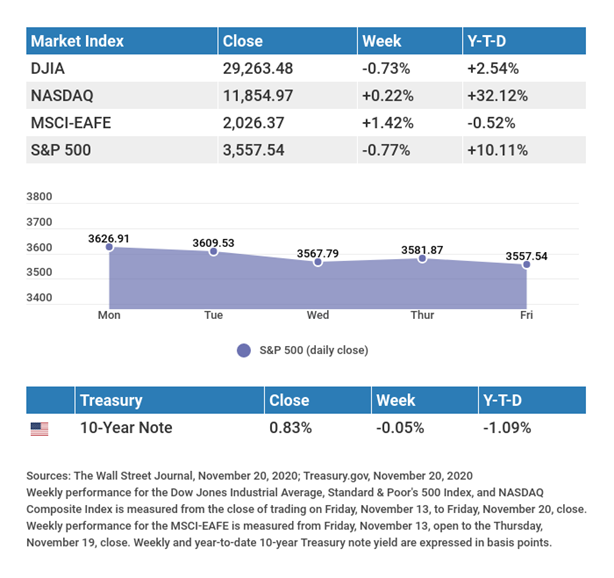

The Dow Jones Industrial Average fell 0.73%, while the Standard & Poor’s 500 declined 0.77%. The Nasdaq Composite index rose 0.22% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 1.42%.1,2,3

Groundhog Week

The announcement of another potential COVID-19 vaccine ignited strong gains to begin the week. But, like the week that preceded it, the gains sparked by the vaccine news were eroded in the following days as worries over the economic impact of new infections moved to the fore.

The market has been grappling with conflicting narratives. One is the optimistic view that, with COVID-19 vaccines apparently near at-hand, the return to economic normalcy grows ever closer. That hopeful outlook has been offset by anxiety over new infections, rising hospitalizations, and some local and state lockdowns.

These crosscurrents kept stocks range bound for the week, with the technology sector and small and mid-size stocks lending support to the overall market.

Powell Sounds a Warning

In a speech last week, Federal Reserve Chairman Jerome Powell warned that the nationwide increase in COVID-19 cases could hamper economic activity in the upcoming months. He expressed concern that consumer spending may trend lower despite efforts to control the spread of infections.4

Powell once again voiced his support for additional fiscal stimulus to assist small businesses, state and local governments, and the unemployed. He also said that even after full economic recovery, some businesses and workers may wrestle with an economic landscape altered by the coronavirus.

TIP OF THE WEEK

While well-meaning friends and family members may offer “advice” about your personal finances, remember that they may lack the education and perspective of a financial services professional.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Consumer Confidence.

Wednesday: Durable Goods Orders, Gross Domestic Product (GDP), Jobless Claims, Consumer Sentiment, New Home Sales.

Thursday: Jobless Claims.

Source: Econoday, November 20, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Best Buy (BBY), Medtronic (MDT), Dollar Tree (DLTR), Dell Technologies (DELL), VMware (VMW), Analog Devices (ADI).

Friday: Deere & Company (DE).

Source: Zacks, November 20, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Never apologize for showing feeling. When you do so, you apologize for the truth.”

BENJAMIN DISRAELI

THE WEEKLY RIDDLE

What five letters (with no letters used more than once) can be arranged in three ways to make three separate words – the first with one syllable, the second with two syllables, the third with three syllables?

LAST WEEK’S RIDDLE: A rooster sits atop a farmhouse. Its roof is unequally pitched. One half slopes down at an angle of 60º, and the other half at 70º. If the rooster lays an egg right on the peak of the roof, on which side is the egg more likely to fall?

ANSWER: Neither. Roosters don’t lay eggs.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, November 20, 2020

- The Wall Street Journal, November 20, 2020

- The Wall Street Journal, November 20, 2020

- CNN.com, November 17, 2020