In this week’s recap: Stalemate in the Capitol; Powell says inflation may stay longer than expected.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |October 4, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

Higher bond yields and a legislative stalemate in Washington, D.C., added up to losses for the week.

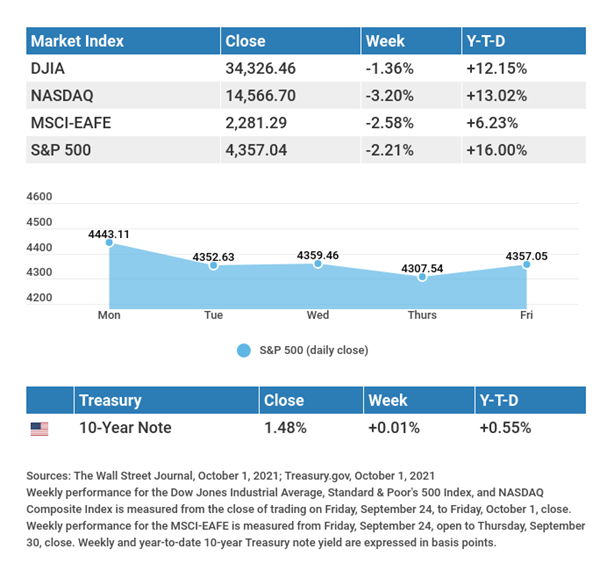

The Dow Jones Industrial Average declined 1.36%, while the Standard & Poor’s 500 lost 2.21%. The Nasdaq Composite index fell 3.20%. The MSCI EAFE index, which tracks developed overseas stock markets, shed 2.58%.1,2,3

AN UGLY WEEK

The reality of a more hawkish Fed finally hit the bond market, sparking a sell-off in bonds that sent yields higher. Higher yields hurt technology and other high-growth companies, and that weakness spread to the broader market. (Higher yields can reduce the value of a company’s future cash flow, which may reset valuations.)

Congress added to the market uncertainty. It was unable to advance an infrastructure bill, and it made little progress on the debt-ceiling agreement. After a sell-off to close out September, stocks surged on Friday on news of a potential Covid-19 oral therapeutic, an easing of yields, and reports that President Biden was traveling to Capitol Hill to help break the logjam on legislation.

POWELL IN THE NEWS

Fed Chair Jerome Powell was at the center of two news developments last week. The first was the announcement by a prominent senator opposing Powell’s renomination, heightening market uncertainty over the leadership transition when his term expires in February 2022.4

Powell later made comments at a European Central Bank event, admitting that the current bout of inflation may last longer than he and many other central bankers have previously expected. But he remained steadfast that inflation would be transitory, attributing much of today’s price pressures to temporary supply bottlenecks. Powell also said that he saw little evidence of building inflationary expectations from consumers or businesses.5

TIP OF THE WEEK

Some people open a retirement account only to “set it and forget it,” leaving the asset allocation unchanged for years. As you get older, be sure to review your allocation choices in light of your risk tolerance and time horizon.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: ISM (Institute for Supply Management) Services Index.

Wednesday: ADP (Automated Data Processing) Employment Report.

Thursday: Jobless Claims.

Friday: Employment Situation.

Source: Econoday, October 1, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: PepsiCo, Inc. (PEP).

Wednesday: Constellation Brands (STZ).

Thursday: Conagra Brands (CAG).

Source: Zacks, October 1, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“In a gentle way, you can shake the world.”

MAHATMA GANDHI

THE WEEKLY RIDDLE

How is seven different from the rest of the numbers between one and ten?

LAST WEEK’S RIDDLE: What can you hold in your right hand, but never in your left hand?

ANSWER: Your left hand.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, October 1, 2021

- The Wall Street Journal, October 1, 2021

- The Wall Street Journal, October 1, 2021

- CNBC.com, September 28, 2021

- APNews.com, September 29, 2021