In this week’s recap: Delta variant continues to concern the markets; labor market shows positive signs.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |September 13, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

In a quiet week of news, stocks moved lower amid simmering concerns over the Delta variant’s effect on the progress of economic reopening.

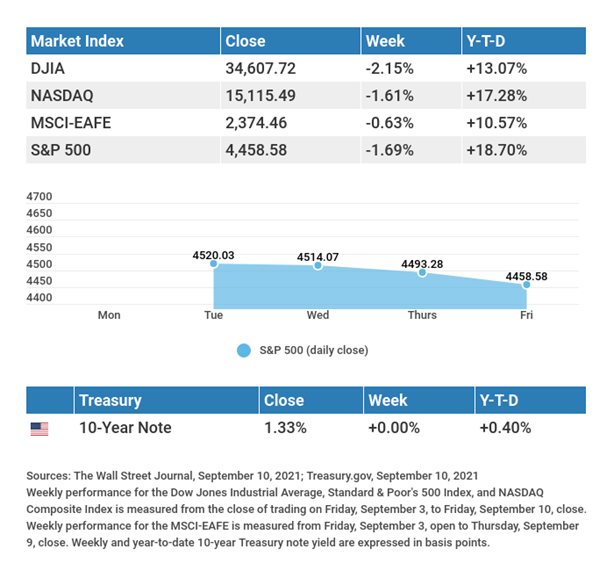

The Dow Jones Industrial Average declined 2.15%, while the Standard & Poor’s 500 dropped 1.69%. The Nasdaq Composite index fell 1.61% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.63%.1,2,3

STOCKS WEAKEN

In a holiday-shortened week of trading, markets were choppy as investors grew cautious in the face of a potential Fed tapering decision later this month and the impact of Delta on the economic recovery.

What little news there was, it was decidedly mixed. Job growth showed real strength coming off a shaky employment report the previous Friday, while the Producer Price Index surged by 8.3% year-over-year, representing the largest annual increase since November 2010. The release reminded investors that inflation remained a market risk. Stocks tried to stage a rebound on Friday before sagging to close out the week.

JOBS IMPROVEMENT

After a disappointing employment report, two labor market reports last week appeared to show that the labor market recovery appeared intact. The JOLTS report (Job Openings and Labor Turnover Survey) showed 10.9 million open jobs, a number that exceeded the number of unemployed by more than two million. The rate of hiring, however, decelerated, perhaps explaining why the August employment report fell short of expectations.4

A day later the weekly initial jobless claims fell to a new pandemic low of 310,000, coming in below its four-week moving average of 339,500. Continuing claims fell to their lowest level since March 14, 2020.5

TIP OF THE WEEK

Your will, trust, and powers of attorney should be reviewed regularly, once a year if possible. Time can alter priorities and intentions.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Lennar Corporation (LEN).

Source: Zacks, September 10, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Pleasure in the job puts perfection in the work.”

ARISTOTLE

THE WEEKLY RIDDLE

You can easily touch me, but not see me. You can throw me out, but not away. What am I?

LAST WEEK’S RIDDLE: I can only live where there is light, but I die if the light shines on me. What am I?

ANSWER: A shadow.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, September 10, 2021

- The Wall Street Journal, September 10, 2021

- The Wall Street Journal, September 10, 2021

- CNBC, September 8, 2021

- CNBC, September 9, 2021